Fixing Medicare Accelerated & Advance Payment Programs Critical to Patient Care Across America

“Hospitals are now on borrowed time. Every day of inaction creates more uncertainty for our patients and our caregivers – jeopardizing patient access to care.” – Chip Kahn, FAH President and CEO

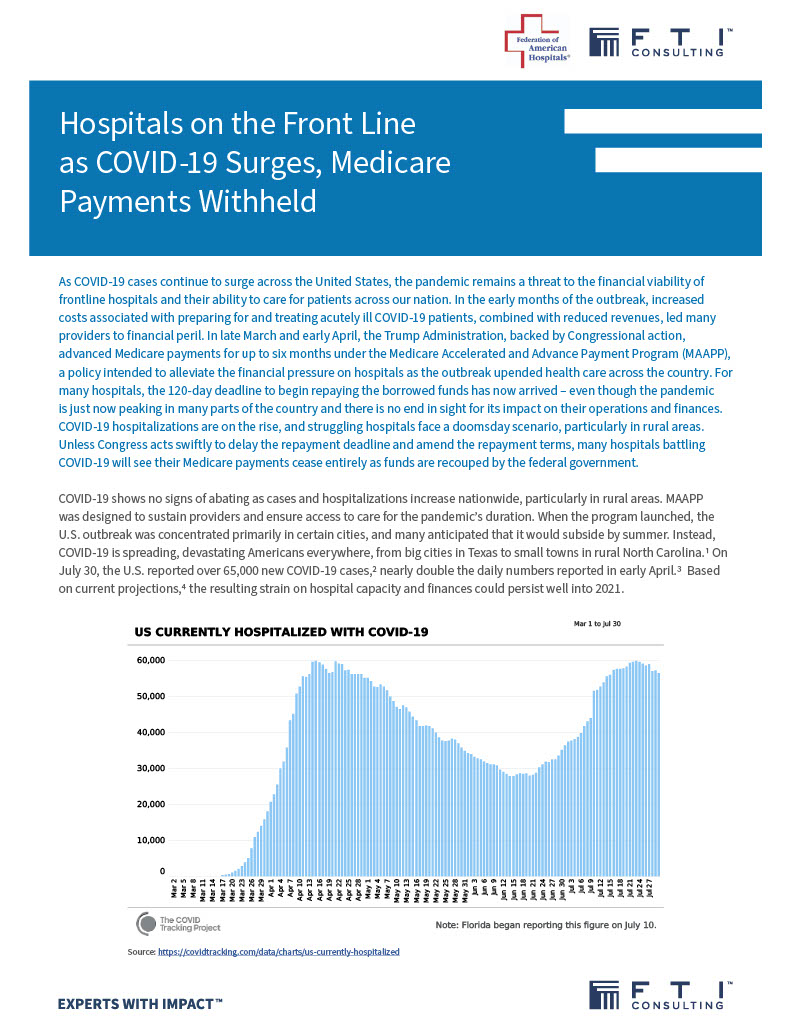

The Medicare Accelerated and Advance Payment Programs’ loans saved hospitals during the COVID-19 shutdown, but now the shortsighted, rigid repayment terms are colliding with the on-going impact of the pandemic.

Frontline facilities and care providers coast to coast have passed the point of no return. Many must pay off the loans right now or have their Medicare fee-for-service payments zeroed out until it is. This will have devastating effects on patient care.